Healthcare and Defence: Top sectors for wealth creation

By

Arihant Team

India’s healthcare and defence sectors are emerging as top wealth creators in 2025. Strong government spending, rising demand, innovation, and expanding global opportunities are driving growth. These sectors offer long-term stability, consistent performance, and promising investment potential for investors.

In This Article

- Introduction

- Key Takeaways

- Why These Two Sectors Stand Out Right Now

- How the Healthcare Sector Can Drive Wealth Creation in the Next Year

- Why Defence Could Outperform Other Sectors in the Coming Year?

- Risks and Realities Investors Should Keep in Mind

- Conclusion

- FAQs

Introduction

India is growing quickly as new projects, better technology and rising incomes continue to shape the economy. People are now more focused on long-term investment ideas that can offer consistent growth over the years.

Within this improving environment, two areas are clearly standing out for investors eyeing long-term wealth creation: the healthcare and defence sectors. The government’s increased focus on defence, with spending now at ₹6.81 lakh crore, signals a strong belief in domestic manufacturing and India’s ability to build its own capabilities. Healthcare is also expanding rapidly, driven by better access to hospitals, wider insurance coverage, and improvements in medical technology. Healthcare spending accounted for 3.3% of India’s GDP in 2022 and is expected to rise to 5% by 2030, highlighting a sector that is strengthening year after year

Key Takeaways

- India’s market outlook is improving, supported by government spending, stronger production activity, and rising consumer demand.

- The healthcare and defence sectors are emerging as the strongest opportunities for wealth creation over the next year.

- Defence is gaining from record government allocation (₹6.81 lakh crore), rising exports, and growing private-sector participation.

- Healthcare is expanding due to higher public investment (nearly ₹1 lakh crore), wider insurance coverage, and rapid digital adoption.

- Both sectors are driven by long-term policy support, growing domestic and global demand, and steady innovation.

- They tend to remain resilient even when other industries face slowdowns, making them appealing for long-term investors.

- Key risks include policy changes, high valuations, execution delays, and global geopolitical factors.

- Overall, the outlook remains positive, with both sectors well-placed to deliver consistent, long-term wealth creation.

For investors who prefer to follow long-term themes, defence and healthcare stocks are beginning to look like indicators of genuine progress, sectors rooted in two essential priorities: national security and public wellbeing.

Let’s take a closer look at how these two industries are powering India’s growth and opening fresh opportunities for investors.

Why These Two Sectors Stand Out Right Now

As markets evolve, investors are beginning to look beyond short-term rallies and focus on sectors that are shaping India’s next phase of growth. Defence and healthcare are leading this shift because they align with two major priorities for the country: security and wellbeing. Both sectors are supported by long-term planning, strong policy execution, and a visible rise in demand.

Several factors help explain why these two areas are drawing attention and performing better than many others right now.

- Strong Government Focus: Both sectors are growing thanks to active support from the government. In defence, programmes like Atmanirbhar Bharat are encouraging companies to manufacture more within India instead of relying heavily on imports. In healthcare, schemes such as Ayushman Bharat and larger health budgets are helping more people access hospitals and insurance. This steady policy push is building confidence among businesses and investors.

- Growing Local and Global Demand: India’s need for modern defence systems and better healthcare continues to rise each year. At the same time, many countries are showing interest in Indian defence equipment and healthcare services. This link between domestic growth and international demand is helping both sectors create wider opportunities for steady and sustainable expansion.

- Innovation and Modernisation: Technology is reshaping how both industries operate. Defence companies are investing in drones, radar systems, and satellite-based equipment, while healthcare firms are using digital tools, telemedicine, and advanced diagnostics. These innovations are improving quality, speed, and accessibility, helping both sectors work more efficiently.

- Long-term Value Creation: Defence and healthcare tend to stay strong even when other sectors slow down. Security and health are always essential, which keeps demand steady. This reliability has made defence and healthcare stocks attractive to investors who prefer long-term, consistent growth over short-term gains.

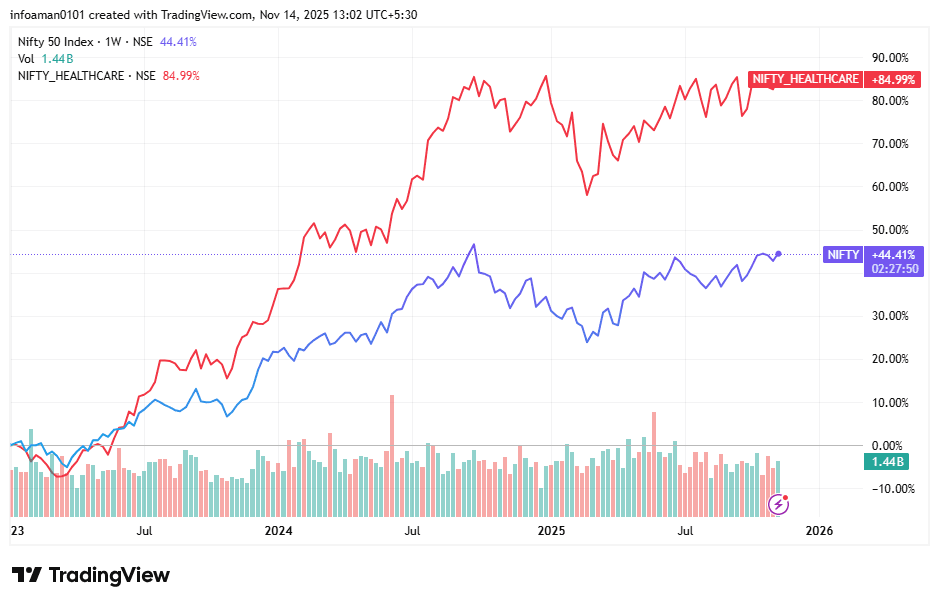

How the Healthcare Sector Can Drive Wealth Creation in the Next Year

India’s healthcare industry is set for strong growth in the coming years as demand for medical services keeps rising and companies continue to invest in better facilities and technology.

The sector comprises numerous businesses. These include pharmaceutical companies that manufacture medicines, hospitals that treat patients, diagnostic laboratories that conduct tests, medical device manufacturers that design equipment, and health insurers that assist individuals in paying for their care.

All these parts work together to form a large and fast-growing industry that is expanding across cities and smaller towns.

- Rising Demand for Quality Healthcare: India continues to face a major gap in access to quality treatment, which creates space for long-term growth. The country has only 1.3 beds per 1000 people, far below the global average of 3.

As lifestyle changes and more people are diagnosed with diabetes, heart disease and other long-term conditions, the demand for healthcare keeps increasing. This growing need, supported by a healthcare market already estimated at ₹56 lakh crore, gives the sector a strong base for expansion.

- Strong Policy Support and Public Investment: In the 2025 Union Budget, the government allocated nearly ₹1 lakh crore towards strengthening hospitals, insurance coverage, and digital health services. Schemes like Ayushman Bharat are also helping more households access affordable care, supporting the growth of hospital chains, insurers, and diagnostics networks.

Healthcare spending has been rising over time from 3.3% of India’s GDP in 2022 and is expected to reach 5% by 2030, which shows how important the sector has become for the country’s development.

- Digital Innovation and Technology Use: Technology is now one of the biggest reasons for change. Telemedicine, online consultations and AI-based diagnostics are helping doctors reach patients in smaller towns and rural areas.

The digital health market, valued at ₹75,658 crore in 2024, is projected to grow to ₹4,11,275 crore by 2033 at a CAGR of 17.67%. This growth is making care easier to reach, lowering costs and allowing companies to serve more people even with fewer physical centres.

- Growing Investor Interest and Global Reach: The sector is also attracting increasing interest from private equity firms. In Q2 CY25, Indian Healthcare saw investments worth ₹4900 crore across 33 deals, reflecting strong faith in its long-term potential. Hospital chains are expanding to smaller cities, pharma companies are increasing exports, and medical tourism continues to grow as patients from abroad visit India for affordable and high-quality treatment.

- Leading Companies in the Healthcare Sector: India’s healthcare industry is supported by several strong and trusted companies. Their consistent growth and growing presence help the healthcare sector stay strong and support rising demand year after year. Here is a list of some of the top healthcare sector stocks in India. These include companies in the entire healthcare spectrum - pharma, hospitals, biotech, and R&D.

- A Promising Space for Investors: For investors, healthcare strikes a balance between stability and growth. Established hospital and pharmaceutical companies have shown consistent returns, while mid-sized and tech-focused firms in diagnostics and health insurance offer notable growth potential.

Why Defence Could Outperform Other Sectors in the Coming Year?

India’s defence sector is stepping into a strong growth phase, supported by rising exports, increased private-sector involvement, and rapid adoption of new technology. With government spending and global interest moving in the same direction, the coming year looks promising for investors.

- A Clear Policy Vision Backed by Record Spending: The ₹6.81 lakh crore allocation in the 2025–26 Union Budget highlights the government’s long-term commitment to modernising defence. Beyond the headline number, this spending helps create predictable opportunities for domestic manufacturers, allowing them to plan production, expand capacity, and invest confidently in new technologies.

- Strong Export Momentum Taking Shape: India’s defence exports have grown significantly, from ₹686 crore in FY2014 to ₹23,622 crore in FY2025. With a fresh target of ₹50,000 crore by 2029, Indian companies are forming partnerships across Asia, Africa, and the Middle East. This shift signals India’s evolution from a defence importer to a credible global supplier.

- Private Sector and Innovation Push: While public entities once dominated the space, private companies and start-ups now contribute nearly 23% of total defence production. Investments in the Uttar Pradesh and Tamil Nadu defence corridors are helping build modern manufacturing hubs, attracting both domestic and foreign investors. This participation is leading to faster innovation and more competitive production.

- Leading Companies in the Defence Sector: India’s defence sector is growing with the help of several leading companies. Public and private firms such as HAL, BEL (Bharat Electronics Ltd), Bharat Dynamics Ltd, Mazagon Dock Shipbuilders, Cochin Shipyard, Solar Industries and MTAR Technologies are involved in building aircraft, ships, missile systems and other key equipment. Their growing work and rising capabilities show how strongly the defence industry is developing within the country. Here is a list of the top defense sector stocks in India.

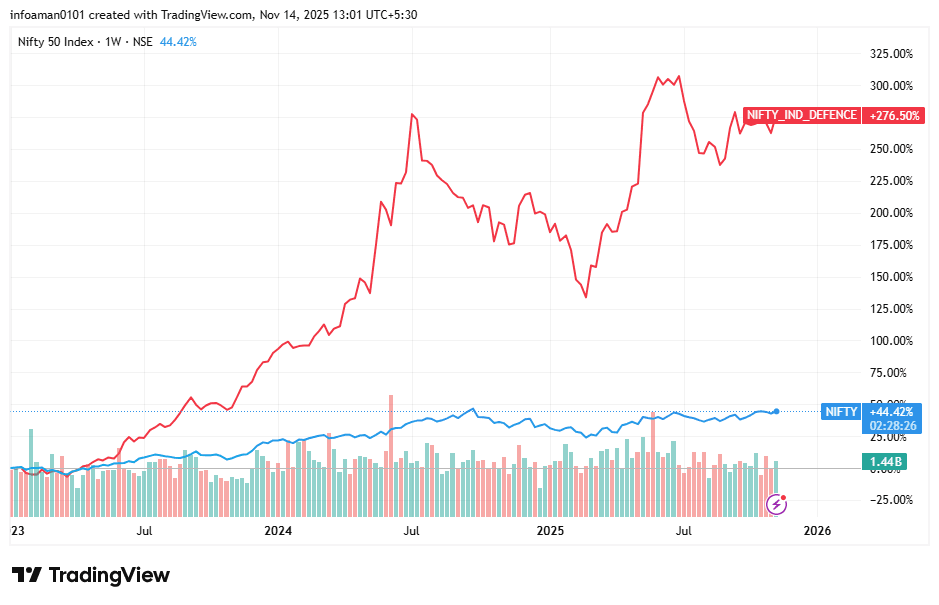

- A Promising Outlook for Investors: The market’s growing trust in this sector is already visible. The NIFTY India Defence Index has gained more than 30% in 2025, reflecting strong investor interest. As companies execute large orders and scale up exports, defence stocks are expected to remain strong wealth creators in the coming year.

Risks and Realities Investors Should Keep in Mind

Although healthcare and defence are well-positioned for strong growth, it’s important to remember that no sector is without challenges. Being aware of these risks early on can help investors make informed, long-term decisions rather than reacting to short-term movements.

- Policy and Budget Dependence: Both sectors rely heavily on government decisions and funding. Any delay in approvals, changes in budgeting, or shifts in policy priorities can slow new initiatives. Defence contracts, in particular, involve long procurement cycles, while healthcare businesses can feel pressure from changes in insurance rules or drug pricing policies.

- Execution and Supply Chain Challenges: Even when companies have large order books, execution is critical. Defence manufacturers may face production delays due to supply constraints or challenges in accessing advanced technology. In healthcare, the pace of expansion, especially for hospitals and diagnostic networks, can be slowed by high setup costs, limited skilled staff, or regulatory hurdles.

- Market Valuations and Investor Expectations: With growing interest from investors, both sectors have seen valuations climb sharply in recent quarters. If earnings growth slows or external disruptions occur, these higher valuations could result in short-term corrections. It’s important for investors to focus on company fundamentals rather than being swayed by momentum.

- Global and Geopolitical Factors: Defence exports depend on stable diplomatic relationships and international partnerships. Any geopolitical tension or policy shifts abroad can temporarily affect contracts. Healthcare, meanwhile, is influenced by global commodity prices and regulatory approvals in export markets, which can impact margins.

- The Importance of Long-Term Patience:

Both sectors tend to reward long-term commitment over short-term speculation. Defence projects and healthcare capacity building often take time before delivering visible results. Investors who prioritise strong management, healthy balance sheets, and sound execution are more likely to see consistent wealth creation over time.

Conclusion

Healthcare and defence are emerging as the twin engines of India’s growth story in 2025. One strengthens national security, while the other improves public well-being. Both are backed by strong policies, rising investments, and consistent demand that continue even when markets turn uncertain.

For investors, the healthcare and defence sectors’ wealth-building potential goes beyond short-term opportunities. With stable fundamentals and long-term visibility, they remain reliable choices for consistent wealth creation.

While risks such as policy delays or high valuations exist, the overall outlook remains positive. With self-reliance, innovation, and execution driving progress, healthcare and defence are well-positioned to lead India’s next phase of sustainable growth.

FAQs

How do global supply chains impact these sectors?

Healthcare relies on imported equipment and raw materials, especially APIs. Any disruption can affect costs and delivery timelines. Defence manufacturing also depends on imported components, though localisation efforts are increasing.

How can investors track developments in these sectors?

You can follow quarterly company results, industry reports, government budget announcements, procurement deals, and export data. For healthcare, tracking regulatory decisions and clinical approvals can also be useful.

Do these sectors offer short-term gains?

They can, but their main strength lies in long-term, consistent wealth creation thanks to reliable demand and structured policy support.

Does the private sector play a role in defence growth?

Yes. Private companies and start-ups now contribute nearly 23% of defence production, helped by dedicated defence corridors in Uttar Pradesh and Tamil Nadu.

Do these sectors attract Foreign Direct Investment (FDI)?

Yes. Healthcare allows 100% FDI in many segments, drawing strong global interest. Defence FDI has also increased due to policy relaxation, though it remains more regulated.

Related Topics